Leading Business Insolvency Company for Strategic Financial Monitoring

Leading Business Insolvency Company for Strategic Financial Monitoring

Blog Article

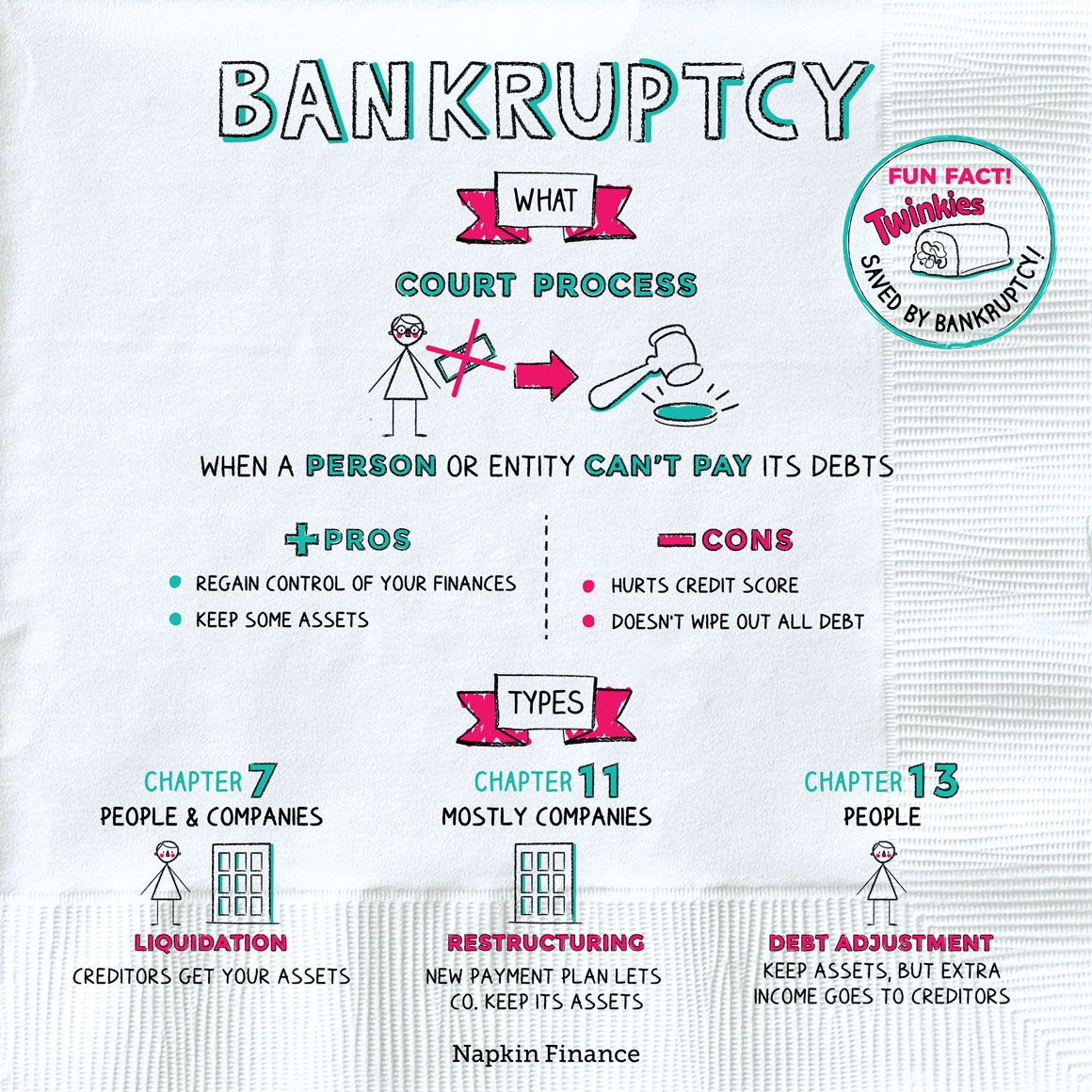

Uncover the Various Elements and Procedures Included in Looking For Bankruptcy Providers for Financial Stability

Navigating the complexities of bankruptcy services is typically a critical action towards accomplishing economic security in difficult times. From analyzing the various types of insolvency to complying with lawful procedures and needs, the trip in the direction of monetary recovery is laden with vital decisions and ramifications.

Recognizing Insolvency Kind

Exploring the various sorts of insolvency can offer a comprehensive understanding of the economic difficulties individuals and companies may encounter. Bankruptcy can materialize in various kinds, each with its lawful proceedings and very own effects. The 2 key kinds of bankruptcy are cash flow insolvency and annual report bankruptcy.

Money circulation insolvency happens when an individual or organization is unable to pay off financial debts as they come due. On the various other hand, equilibrium sheet insolvency occurs when the overall responsibilities of an entity exceed its total assets.

Recognizing these distinctions is important for people and businesses looking for bankruptcy solutions - Business Insolvency Company. By recognizing the kind of insolvency they are facing, stakeholders can deal with insolvency specialists to create customized remedies that address their particular financial circumstances

Legal Procedures and Demands

Browsing the complexities of lawful procedures and needs is essential for individuals and transaction with bankruptcy. When encountering economic distress, comprehending the legal structure surrounding bankruptcy is crucial for an effective resolution. One essential aspect is recognizing the appropriate insolvency procedure based on the certain circumstances of the debtor. This could involve declaring for insolvency, suggesting a financial debt repayment plan with a Private Volunteer Arrangement (IVA), or opting for a Business Voluntary Plan (CVA) for organizations.

Additionally, following legal requirements such as providing exact economic info, going to court hearings, and coordinating with bankruptcy professionals is essential throughout the process. Abiding by timelines set by the court and conference coverage commitments are additionally necessary parts. Additionally, comprehending the civil liberties and obligations of all events entailed, including lenders and borrowers, is important for a reasonable and clear bankruptcy procedure. By adhering to the lawful treatments and requirements carefully, individuals and organizations can browse the bankruptcy process effectively and function towards achieving financial stability.

Effects of Insolvency Actions

Recognizing the ramifications of insolvency actions is essential for companies and individuals seeking economic security. In addition, insolvency activities can lead to damage in credit ratings for people and companies, making it challenging to protect fundings or debt in the future. Bankruptcy may also result in legal activities taken against the entity by creditors to recoup financial debts owed.

Dealing With Insolvency Professionals

In partnership with knowledgeable bankruptcy individuals, professionals and businesses can successfully browse complex monetary difficulties and discover tactical solutions for sustainable recovery. Insolvency professionals bring a riches of know-how in economic restructuring, bankruptcy regulations, settlement methods, and court treatments to the table. Their support can be critical in analyzing the financial scenario, recognizing sensible alternatives, and establishing a comprehensive strategy to attend to insolvency problems.

Working with bankruptcy professionals entails a structured method that commonly begins with a thorough assessment of the economic status and the underlying sources of insolvency. This assessment aids in creating a customized strategy that aligns with the particular requirements and objectives of the specific or organization encountering insolvency. Insolvency professionals additionally play a vital duty in facilitating communication with creditors, discussing settlements, and representing their clients in legal procedures if required.

Getting Financial Security With Insolvency

Given the calculated advice and proficiency offered by insolvency companies, professionals and individuals can currently concentrate on carrying out procedures go to the website targeted at securing economic security through bankruptcy proceedings. Bankruptcy, when managed properly, can work as a device for reorganizing debts, renegotiating terms with creditors, and inevitably recovering financial visit this page health. With insolvency processes such as financial debt liquidation, restructuring, or reconstruction, people and companies can resolve their financial difficulties head-on and work in the direction of a sustainable monetary future.

Protecting financial stability through insolvency requires a detailed understanding this post of one's monetary scenario, a realistic assessment of debts and possessions, and a critical strategy for progressing (Business Insolvency Company). By functioning very closely with insolvency individuals, services and professionals can browse the complexities of bankruptcy procedures, abide by lawful requirements, and make educated choices that line up with their long-lasting financial objectives

Final Thought

In conclusion, looking for insolvency services involves understanding the different kinds of bankruptcy, adhering to legal procedures and demands, and taking into consideration the effects of bankruptcy actions. Collaborating with bankruptcy experts can assist organizations and people navigate the procedure and work towards safeguarding financial stability. It is very important to thoroughly think about all aspects of insolvency prior to continuing to make certain a successful result and lasting economic health.

The two main kinds of bankruptcy are money circulation bankruptcy and equilibrium sheet bankruptcy.

Insolvency professionals bring a wide range of expertise in economic restructuring, insolvency regulations, negotiation strategies, and court procedures to the table.Functioning with insolvency professionals includes an organized approach that typically starts with a detailed analysis of the economic condition and the underlying reasons of insolvency.Provided the critical guidance and knowledge supplied by insolvency specialists, businesses and individuals can now focus on carrying out steps intended at securing financial stability via bankruptcy process.In final thought, looking for insolvency solutions involves understanding the various kinds of insolvency, adhering to lawful procedures and needs, and thinking about the ramifications of bankruptcy actions.

Report this page